Bridging the Gap: Risk Taking and Rational Decision Making

((the majority of this post was inspired by Nassim Nicholas Taleb and his Medium posts https://medium.com/@nntaleb))

Quick Preface: if you feel I am misunderstanding or misrepresenting the concepts trying to be explained in this post, tell me! I am not an expert nor claim to be, I am simply trying to learn and in turn, share the lessons.

It is my opinion that a lot of people don't bridge that connection between the idiotic, eccentric entrepreneur and the massively successful icons. Some people do bridge that gap, like venture capitalists and co-founders... but most don't. My theory is that the person who can't bridge that gap has not learned the ability to make rational decisions based on risk and reward. If they knew how to do so, they would understand that the greatest entrepreneurs are able to break things down to their principles, and make a rational decision based on the risk associated with the "experiment" that is pursuing their own venture.

here are some examples to help explain this proposed theory:

1. The Founders of AirBnB were struggling to pay rent in 2008-2009 (which is a time where I am sure most people where). They decided set up a airbed and breakfast in their loft, knowing that finding hotels in San Francisco isn't always the easiest. Break that thought process down: hotels are full and expensive + rent is expensive + people need places to stay when traveling + people would be interested in renting their home for some extra cash = rational risk taken to actually start a AirBnB.

2. SpaceX broke down the building of rockets to its principles. They found (through much trial and error) that is was possible to significantly reduce the cost of making, and launching, rocketships. They made a rational decision to take the risks necessary to start a business.

I am sure there are more great examples, but I really want to dive into adding some data to support my theory...so, I started researching Ergodicity, Risk Taking, and Rational Decision Making

Step one: what in the world is that ridiculous "ergodicity" word? let's check wikipedia:

Ergodicity means the ensemble average equals the time average. A good example of what that means is using resistors. Resistors by nature have an associated thermal noise that depends on the temperature. Take a large amount of resistors and plot the voltage across them for a long period of time. For each resistor you will have a waveform. Calculate the average value of that waveform; this gives you the time average. Logically, you will have a certain amount of waveforms for each resistor. These voltage, waveform, resistor plots are known as an ensemble. Now take a particular instant of time in all those plots and find the average value of the voltage. That gives you the ensemble average for each plot. If ensemble average and time average are the same then it is ergodic.

Confusing right? but also sounds pretty cool.. but what's the reason? why do you want to know if something is ergodic? well, let's look at the next wikipedia link talking about theory

Ergodic theory is often concerned with ergodic transformations. The intuition behind such transformations, which act on a given set, is that they do a thorough job "stirring" the elements of that set. e.g., if the set is a quantity of hot oatmeal in a bowl, and if a spoonful of syrup is dropped into the bowl, then iterations of the inverse of an ergodic transformation of the oatmeal will not allow the syrup to remain in a local sub-region of the oatmeal, but will distribute the syrup evenly throughout. At the same time, these iterations will not compress or dilate any portion of the oatmeal: they preserve the measure that is density.

blah blah another analogy - still unclear? well if you take ergodicity into account when talking risks and decision making, you would be able to understand if your risk is ergodic, or not. If your risk is ergodic in nature, then it will be like the oatmeal and the syrup... meaning the risk will be impossible to contain into one local sub-region and will remain uncompressed and non dilated in their evenly distributed measures of density. Basically, you have to fully acknowledge that some risks just cannot be contained and must be accepted when your set is starting a business.

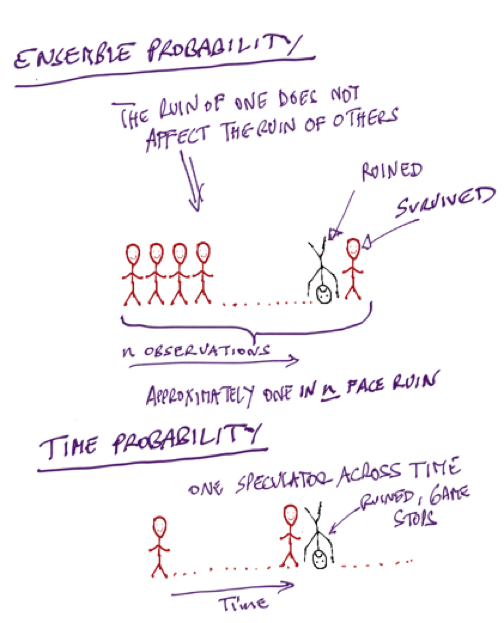

Once you acknowledge and accept that, you can start taking steps necessary to take risks. One of those steps is understanding the probability of those ergodic risks happening and what the outcomes will be. Scroll back up to the picture - what is being illustrated is the probability behind N people going to gamble on roulette, and betting their entire life savings. Certainly, one person is going to fail. However, one person failing does not stop the others from winning. Conversely, if you gave one person N number of times to gamble their entire life savings on roulette, one failure inhibits the probability of the rest of the tries... as in they would lose their entire life savings and could not bet again.

So let's apply this to the two company examples above, understanding both had ergodic risks on either side of the spectrum - one end being starting a business and the other being personal.

1. AirBnB

Business side of the spectrum:

- people letting strangers into their home

- legalities of doing so

- people even being interested

Personal side of the spectrum:

- not making rent that month

- letting a stranger into their home

2. SpaceX

Business side of the spectrum:

- rockets have been expensive since their inception

- historically a money dump and waste of time

- no one would trust a non government space operation

personal side of the spectrum

- wasting entire personal wealth

- sacrificing life/time

- getting assassinated for having a space program in the US beat another country

okay, okay admittedly I got a little carried away there. But this is exactly where the gap widens when trying to bridge the eccentric entrepreneur and the successful icon. My example risks are purposely wild in nature. Reason being: you have to accept and take the risks, and account for them in the art of rational decision making.

AirBnB's rational decision was that the entire operation was doable without quitting their day jobs. They sold custom cereal at the breakfast portion of their AirBnB and used the profits as initial seed funding. They exploited a saturated and expensive hotel market in San Francisco. They took a calculated risk to disrupt and innovate.

similarly, SpaceX's rational decision was that the raw materials necessary to making a rocket could be minimized, and that a rocket that is reusable would drastically reduce the cost of launching it. Both of those factors only stand to maximize profit. The existing industry's technology, and model, was old and ready for disruption and innovation.

In both cases they definitely did not mitigate all of the risks presented, they simply chose to live with them because the benefits out weighed the negatives. But how do you get to the point where you can start making decisions that involve taking risks? well, you learn to be antifragile and love some risks:

"Antifragile revolves around the idea that people confuse risk of ruin with variations –a simplification that violates a deeper, more rigorous logic of things. It makes the case for risk loving, systematic “convex” tinkering, taking a lot of risks that don’t have tail risks but offer tail profits. Volatile things are not necessarily risky, and the reverse. Jumping from a bench would be good for you and your bones, while falling from the twenty-second floor will never be so. Small injuries will be beneficial, never larger ones. Fearmonging about some class of events is fearmonging; about others it is not. Risk and ruin are different tings."Nassim Nicholas Taleb

In both company's cases, the first risks they took were relatively small... aka a startup. Airbed and Breakfast was started with one guest in the founder's own loft. SpaceX was a mere 7 people (including Musk) in a garage like run down warehouse. They continued to stumble through their processes, accepting larger risks when it was necessary and possible to do so. They scaled, and with each experimental leap from an every scaling bench their knees got stronger.

That is all well and good, but you need to begin looking at the data objectively in order to make sure your decisions are truly rational and your risks verse rewards are real. Additionally, loving risk is not good alone... you need to be able to own the risks too.

"Metrics are always always gamed: a politician can load the system with debt to “improve growth and GDP”, and let his successor deal with the delayed results." Nassim Nicholas Taleb

He goes on to say: "In addition, owning one’s risk was an unescapable moral code for past four millennia, until very recent times. War mongers were required to be warriors. Fewer than a third of Roman emperors died in their bed (assuming those weren’t skillfully poisoned). Status came with increased exposure to risk: Alexander, Hannibal, Scipio, and Napoleon were not only first in battle, but derived their authority from a disproportionate exhibition of courage in previous campaigns. Courage is the only virtue that can’t be faked (or gamed like metrics). Lords and knights were individuals who traded their courage for status, as their social contract was an obligation to protect those who granted them their status. This primacy of the risk-taker, whether warrior (or, critically, merchant), prevailed almost all the time in almost every human civilization; exceptions, such as Pharaonic Egypt or Ming China, in which the bureaucrat-scholar moved to the top of the pecking order were followed by collapse."

That is a lot of words that, to me, meant the bridge that spans the gap and connects the eccentric to the icon is their ownership of risk and courage to do so. HOWEVER, obviously the warrior needs to be a skilled combatant and practice his or her craft before just blindly charging. Don't make courage and ownership blind idiocy... a rational decision that takes risks has research, plans, and execution.

In Conclusion, the key to bridging the gap between a crazy person and an icon is talking to that person and listening for indicators of who they are, and what their pitch is. Is the startup taking risks with rational decisions? is the founding team made up of skilled warriors who are prepared to take ownership? After answering those questions, ask the same of yourself. Don't bet your entire life savings on roulette, and always split with partners :)

Please feel free to comment, critique, and share!

Sincerely,

MBMJeremy

Comments

Post a Comment